Roobet

This online casino has fully dedicated itself to the Roo-theme. Of course, we want to find out if our Roobet experiences are as creepy as well, and what can we say: Roobet Casino can definitely convince us. On this page, you can find all the details about the security as well as the crypto payment methods and the classic payment service providers. Of course, we also checked the bonus offers and the game selection in the test.

To protect you from online casino fraud and deception, we always first make sure that the tested internet gaming halls have valid licenses. Only if the casinos are regulated do we proceed with the review. Of course, we also took this into account in the Roobet test for our rating.

About Roobet

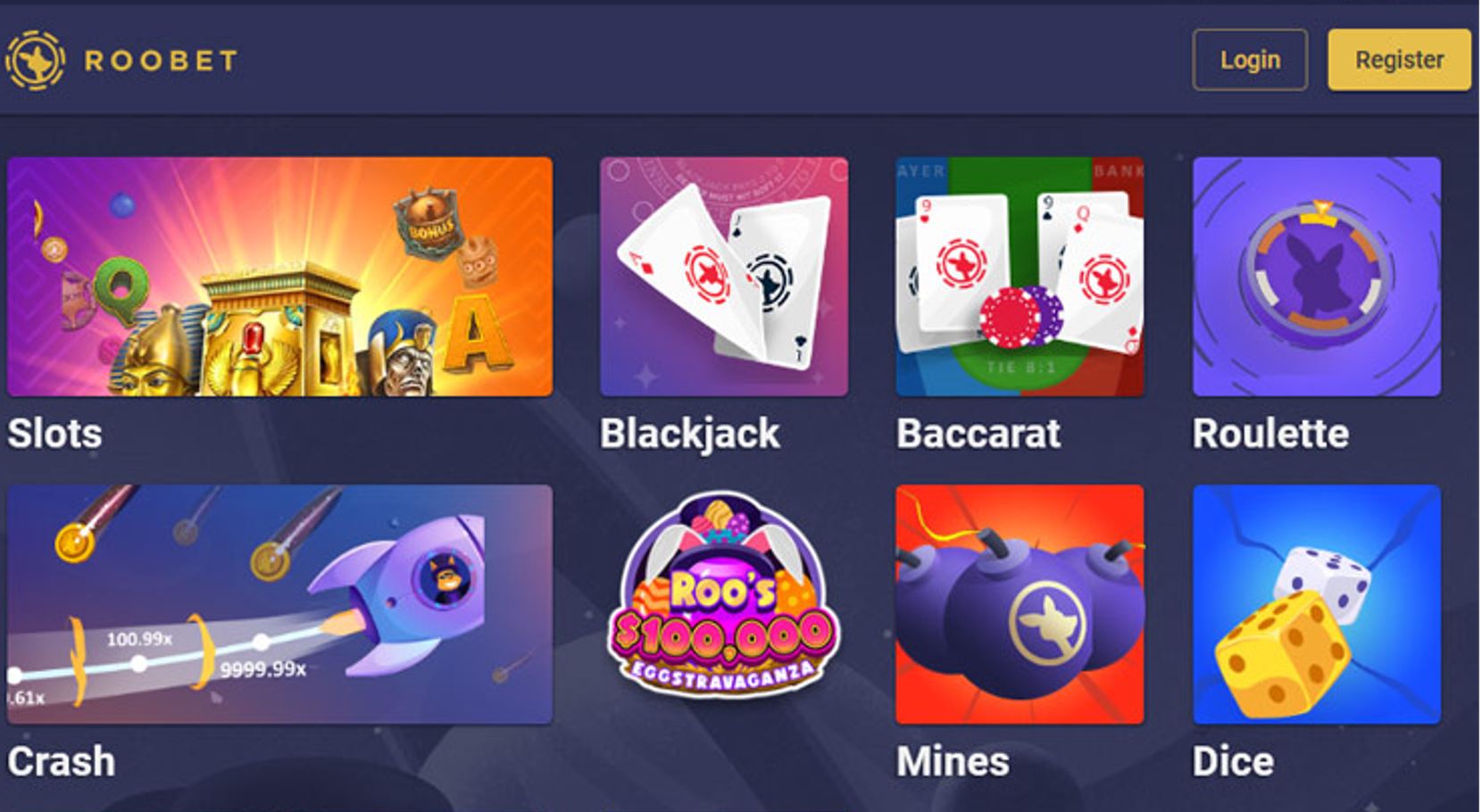

The Roobet Casino knows how to convince directly in the test. A colorful presentation and an individual design promise a good gaming experience. You will find almost all popular casino games. From online slots, jackpot slots, table games like roulette, blackjack and poker to live dealer games.

The game manufacturers guarantee you high quality. About 30 providers make their games available to the online casino. Among them are well-known developers like Play’n GO, Microgaming and NetEnt, but also up-and-coming software manufacturers like Playson, ELK Studios or Push Gaming.

In our review on this page you will get all the information about our Roobet experience. We explain why you are protected from fraud and why we classify this provider as reputable. In addition to the licensing, we also look at the payment methods offered and how trustworthy they are.

Of course, we also collect experiences with the selection of games for you. What is offered and how good is the quality of the games are just a few questions that we try to answer. In addition, we test the customer support for you and deal with the bonus offer of the online casino.

The offer in detail

Our Roobet experiences have shown that this online gaming hall advertises more than 3,000 casino games. The biggest share is clearly taken by popular slot machines like Starburst and Book of Dead or even the Push Gaming slots, as well as table games like blackjack, baccarat, roulette and casino poker. The portfolio is rounded off by Keno, Bingo, Sic Bo as well as Video Poker variants. In addition, some scratch card games are waiting for you.

NetEnt and Microgaming are probably the best-known developers at Roobet Casino. Especially NetEnt has many fans, which is probably due to the great franchise slots like Narcos or Vikings.

Roobet in the test: scam or serious?

We can confirm: Roobet fraud is impossible! Due to the license of the authority of Curaçao, players are also allowed to legally play for real money at this online casino.

In order for the provider to receive the license, it must create the framework for protected play. Among other things, the IT company ensures that you can safely play for real money and that no third party has access to your data.

Another positive factor that makes it clear that rip-offs don’t stand a chance at Roobet Casino is a look at the payment service providers provided. Among them you will find listed companies such as Visa and Mastercard, which simply cannot afford to cooperate with dubious providers, as they are under stock exchange supervision.

Games

Know our team, engineers and our Roobet Casino experiences in the test have made one thing clear: This provider is a top address for slot fans. The fact that the provider can compete with the best slot casinos can be seen on the one hand in the many different categories, but also in the excellent manufacturers such as Pragmatic Play and Big Time Gaming.

The table games are also well represented. In addition to a blackjack category, you’ll find roulette in the Wheels section, as well as some poker variants in the Whispers section. A few video poker games can be found in the category of the same name as well as some casino poker games. Properly assigned are the online casino games in any case.

Games like Keno, Sic Bo and Bitcoin Plinko have to be searched for separately if you don’t want to scroll through all the games. At first, we thought there was no live casino until we discovered the Undead Casino section. The games are from Evolution and Pragmatic Play Live and there are over 170 live tables at Roobet. Besides Live Roulette, Blackjack, Baccarat, Sic Bo and Dragon Tiger, you can also play many live game shows like Monopoly, Deal or No Deal or Dream Catcher.

Deposits and withdrawals

If you want to receive a bonus, you have to make a deposit beforehand. There are eleven payment methods to choose from. Our Roobet Casino experience was accordingly good. There is a suitable payment option for everyone. From the classic credit card payment to instant transfer.

Nowadays, there are many credit card online casinos, because the transaction with Visa and Mastercard has proven itself and these are considered extremely reputable. However, more and more people nowadays also favor modern payment methods such as eWallets or payments with cryptocurrencies like Bitcoin, Ethereum and Litecoin.

You should look into the payment options before making a deposit. Generally, it is recommended to choose the same method for both deposit and withdrawal, as it simplifies the process and allows for quick payouts. For example, you can deposit and withdraw money using Bitcoin.

If you choose a different withdrawal method, you will probably need to confirm your identity. For this, you would have to submit a valid document. This way, Roobet fraud is excluded. Neither your deposit nor your withdrawals will incur any costs or fees.

Bonus offer at a glance

The Roobet bonus is something very special. As a new player, you have the option to choose from seven different welcome bonus offers. With this option, this online casino surpasses some of the best online casino bonus offers currently available. Each offer is automatically credited to your player account after you make a deposit.

We have picked out for you the Roobet Casino bonus that will bring you the most if you are new to online gambling. Please keep in mind that you always have to fulfill the bonus conditions before you can make a withdrawal.

As already mentioned, you have to fulfill the wagering requirements before you can withdraw your Roobet bonus offer. You can find all the important information about this in the terms and conditions. You have a total of 10 days to fulfill the turnover. With a few exceptions, almost all slots, bingo, keno and scratch cards contribute 100%. In total, you have to wager the bonus 30x and the winnings from the free spins 30x.

Live games as well as table and card games like blackjack, roulette and poker contribute to 15%. However, the game of Baccarat is excluded in each case. Also, you can play video poker games that contribute to 15%. Jackpot slots, by the way, also do not contribute to the revenue. The maximum bet per spin is $10.

However, there are other bonus promotions that you can opt for. You can choose a bonus package that tops up your first three deposits, a 120% bonus or you can get a 15% cashback or 20% cashback on live games. You can also get one free spin for every dollar you deposit if you like slots.

The customer service at Roobet

Questions can always arise – so it is all the more important that they are answered. The customer service also tells you whether the Roobet is reputable or not. This provider is extremely customer-oriented and offers various contact options. You have the chance to contact the customer center by phone or by email.

You also have the option to find the right answer in the FAQ section or to contact the 24/7 live chat. Although there is a customer service, it was not available in our Roobet test, so we had to deal with an English-speaking customer service representative, who was able to help us.

Security and regulation

Thanks to the valid license, you can play completely safe and legal in the online casino Roobet. The provider must meet many requirements to obtain such a license. This way you can be sure that all games are fair as well as your data is protected from third parties.

The IT company is responsible for the protection of personal data. For this, the company relies on TLS encryption, which was formerly known as SSL. The fairness of the games is ensured by independent test labs, which regularly check the payout odds and the random number generator of the games. While no testing lab is explicitly mentioned, we know from our experience that the game manufacturer NetEnt has its titles tested by eCOGRA.

Responsible gaming is also taken care of. Players who develop problematic gaming behavior can always contact the GamCare organization. Parents also have the option of installing CyberPatrol and Net Nanny filtering software.

The mobile app from Roobet

Meanwhile, online casinos apps have become indispensable in the world of virtual gambling. It has become too normal for players to be able to play for real money on the go on their smartphone or tablet. You can play all the games at Roobet mobile casino on your cell phone.

NBA analytics: https://nbaodds.ph

We especially liked the fact that you don’t have to download an extra casino app. It’s perfectly sufficient to access the casino page via your mobile device. And just like any of the best mobile roulette casinos, the site of this top provider is compatible with iOS, Android and Windows devices. On the plus side, you can deposit money on the go and don’t have to sit at your PC to do so. One more tip: It is best to play on Wi-Fi, otherwise you will use up a lot of data volume. If the connection is lost, the game pauses automatically and you can continue or restart it.

Conclusion

In the big online casino comparison, this arcade was able to convince us with its great design. Not many providers focus on a particular theme and pull it off so consistently. In addition to the tremendously large game selection and the great live casino, the many tournaments convinced us. Be it the Slot of the Week or the Drops & Wins Live Casino Tournament.

We also had many plus points and good Roobet Casino experiences with the many different welcome bonus offers. Due to the variety, every player can really find the right offer that suits them. Whether high bonus amounts or many free spins – there is a suitable bonus for everyone.